MENU

PARTNERS

CONTACT

General Help Technical Support Inspection Requests Sales Telephone: 1-800-423-7099 Facsimile: 1-732-458-1156UPFRO ASSOCIATES, INC.

321 Mantoloking Rd. Suite 2D

Brick, NJ 08723

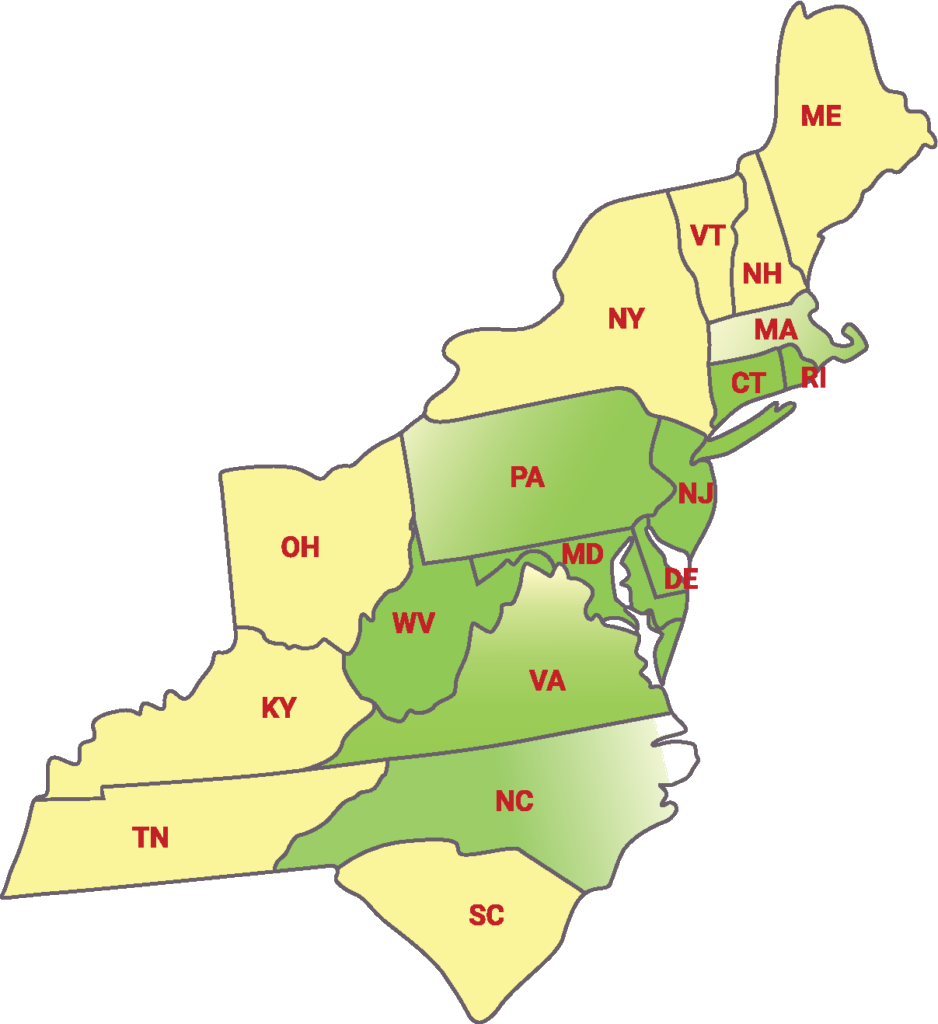

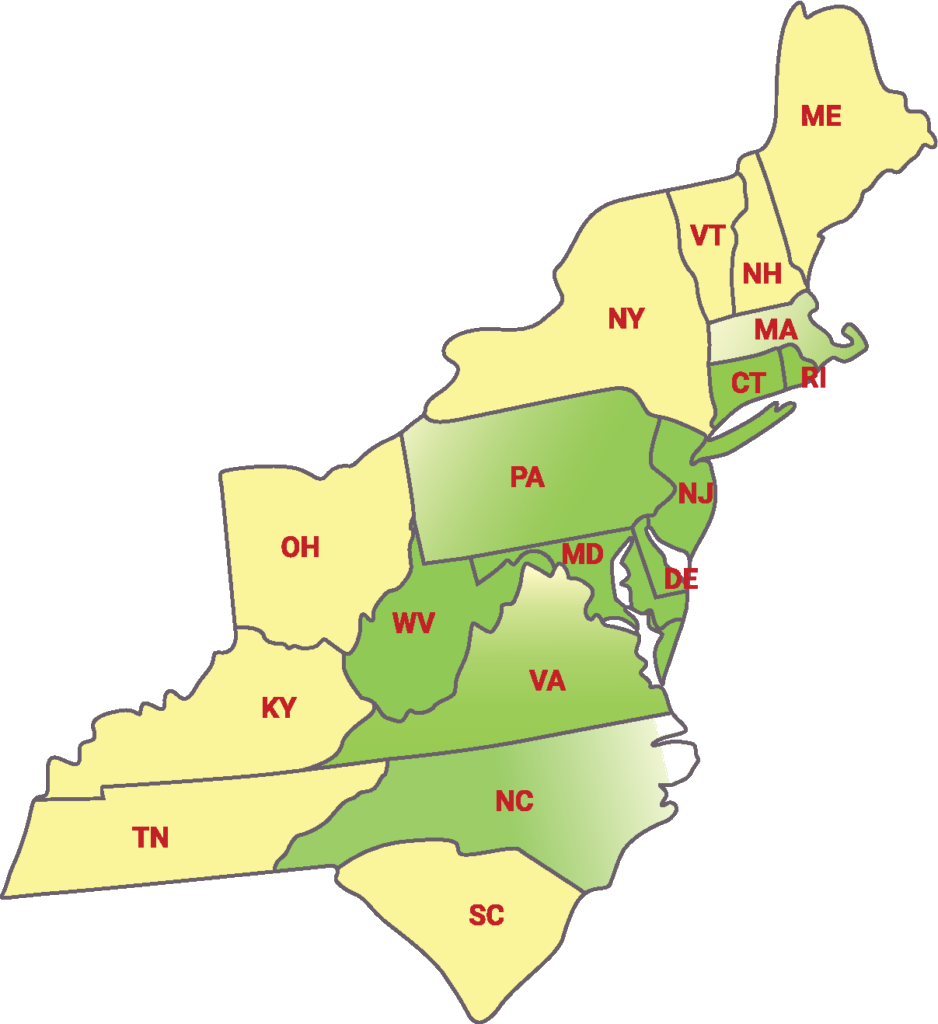

SERVICE AREA

UPFRO combines real-world inspection experience with computer vision and automation to surface hazards, conditions, and underwriting concerns in seconds.

Our models are trained on UPFRO’s standard hazard lists, aligning every bounding box and classification with the way carriers actually think about risk.

Instead of generic “AI flags,” carriers see hazards in their own terms: cracked stucco, missing handrails, trip hazards, vegetation touching structure, and more — all mapped cleanly to underwriting rules.

UPFRO doesn't replace the process — we amplify it. Images flow in from inspectors and homeowners; AI returns structured hazard data, severity, and clear commentary.

Existing vendors, self-surveys, or traditional inspections — if it has photos, it can flow into the UPFRO AI layer with minimal disruption.

Our models detect hazards, draw bounding rectangles, and map findings back to your underwriting logic, complete with severity and narrative.

We deliver structured data, PDFs, and images via PDF, JPEG, API, or SFTP—returned in a format customized to your reporting standards.

by calling or Emailing us today!